22.1.2026

How Fixed Deposits Help You Earn More on Idle Money

9 min read

Learn how fixed deposits work and how they help you earn predictable returns on idle money with minimal risk.

Idle money is a common situation for many people. Funds may sit unused while you plan a large purchase, build an emergency reserve, or simply wait for the right investment opportunity. In these cases, the main challenge is preserving capital while still earning something on top of it. Fixed deposits exist precisely for this purpose.

This article explains how fixed deposits work, why banks offer them, and how they can help you earn predictable income with minimal risk. The focus is on clarity, structure, and decision-making rather than promotion or promises of high returns.

What Is a Fixed Deposit?

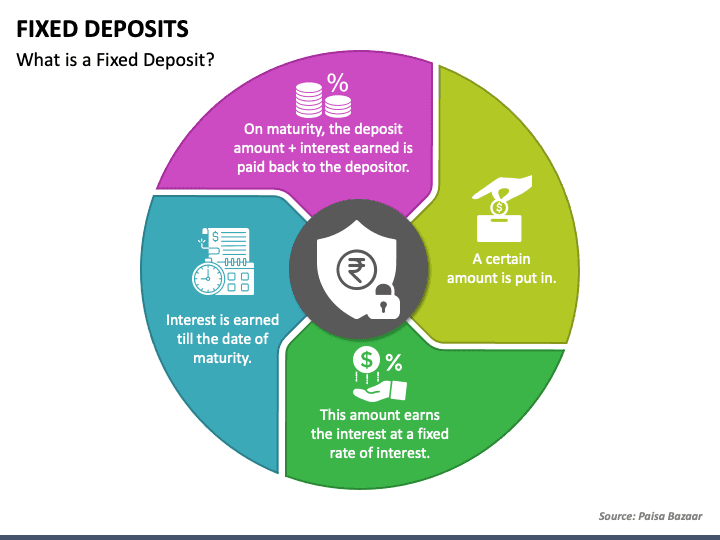

The question what is a fixed deposit usually arises when people compare savings options that offer more stability than market-based investments. A fixed deposit is a financial arrangement where you place a specific amount of money with a bank for a predetermined period at an agreed interest rate. During this time, the funds are not meant for everyday use.

To explain fixed deposit in simple terms, it is a time-bound savings product. You commit your money for a fixed tenure, and in return, the bank commits to paying a fixed rate of interest. The certainty of both duration and return is what distinguishes fixed deposits from most other savings instruments.

In practice, fixed deposits are often used when money has a clear time horizon. Many banks structure fixed deposits this way so customers can set aside funds they do not plan to touch for a defined period while earning a predictable return.

Practical example of a fixed deposit

For example, imagine an individual has $10,000 that is not needed for daily expenses. Instead of keeping this money in a regular savings account, they open a fixed deposit for 12 months at an annual interest rate of 6%.

During this period, the funds remain locked and are not used for everyday transactions. At the end of the term, the individual receives the original $10,000 plus $600 in interest, resulting in a total of $10,600 at maturity.

This simple structure allows the depositor to know in advance how much they will earn, making fixed deposits suitable for planning and protecting idle money from unnecessary risk.

What Is a Fixed Deposit Account?

A natural follow-up question is what is a fixed deposit account and how it differs from a regular bank account. This type of account is not designed for transactions such as payments or transfers. Instead, it functions as a deposit certificate that records the principal amount, interest rate, and maturity date.

Once opened, the account remains largely inactive until maturity, when the bank releases the principal along with the earned interest. This structure is intentional, as it allows banks to plan their lending activities while offering customers stable returns.

Fixed Deposit Explained in Simple Terms

In everyday language, fixed deposit explained means parking money safely for a while and getting paid for your patience. You trade liquidity for predictability. Instead of having instant access to funds, you accept limited access in exchange for higher interest compared to standard savings accounts.

How Does a Fixed Deposit Work?

Understanding mechanics is essential before committing funds. Many people ask how does fixed deposit work because the simplicity of the product can be misleading.

When you open a fixed deposit, you choose:

- the deposit amount,

- the tenure (for example, 6 months, 1 year, or longer),

- the interest payout method.

From that moment, the conditions are locked in. For example, once these choices are made, the deposit is treated as a closed agreement. In practice, no further actions are required from the customer until maturity, which is why fixed deposits are considered a passive savings instrument.

How Does a Fixed Deposit Work Step by Step?

To clarify how does a fixed deposit work, the process can be broken down into stages. First, you transfer a lump sum to the bank under fixed deposit terms. Second, the bank uses these funds as part of its lending pool. Third, interest accrues over time according to the agreed rate. Finally, at maturity, the bank returns your principal plus interest.

Some users phrase the question differently and ask how does the fixed deposit work in practice. Operationally, the product remains passive on your side. No active management is required once the deposit is set up.

How Fixed Deposit Works Over Time

Another common variation is how fixed deposit works across different tenures. Short-term deposits typically offer lower interest, while longer tenures provide higher rates. This reflects the bank’s ability to use your money for extended lending activities.

Regardless of tenure, the core principle remains the same: fixed terms, fixed returns, and limited access until maturity.

How Do Fixed Deposits Help You Earn More Money?

Fixed deposits are not designed for aggressive growth. Instead, they aim to improve the efficiency of idle cash. By locking funds temporarily, you allow the bank to compensate you with interest that is usually higher than what standard savings accounts offer.

Interest can be paid monthly, quarterly, annually, or at maturity. The choice depends on whether you need periodic income or prefer compounding.

Over time, this predictable structure allows fixed deposits to function as a stabilizing element in a broader financial plan, especially during periods of economic uncertainty.

Fixed Deposit Benefits

The main appeal of fixed deposits lies in their stability. Fixed deposit benefits are closely tied to risk control and predictability rather than high returns.

One of the primary advantages is certainty. You know in advance how much you will earn and when you will receive it. This makes planning easier and reduces exposure to market volatility.

Benefits of Fixed Deposit for Conservative Investors

Among the commonly cited benefits of fixed deposit, capital preservation is often the most important. Fixed deposits are generally considered low-risk because they are not linked to market performance. The interest rate does not fluctuate after the deposit is opened.

Another benefit is simplicity. Fixed deposits do not require financial expertise, ongoing monitoring, or complex decision-making once established. In practice, conservative investors often use fixed deposits as a place to hold surplus cash between larger financial decisions, such as property purchases or long-term investments, without exposing that money to market volatility.

Benefits of a Fixed Deposit Account Compared to Regular Savings

The benefits of fixed deposit account structures become clear when compared to regular savings. While savings accounts offer flexibility, they usually provide lower interest rates. Fixed deposits compensate for reduced liquidity by offering higher and more predictable returns.

This trade-off suits individuals who already have sufficient liquid funds and want to optimize surplus cash.

Fixed Deposit vs Savings Account

Choosing between a fixed deposit and a savings account depends on intent. Savings accounts prioritize accessibility, while fixed deposits prioritize returns and discipline.

A fixed deposit is better suited for funds that you do not plan to use in the short term. Savings accounts are better for emergency funds and daily transactions. Understanding this distinction prevents mismatched expectations and unnecessary penalties.

What to Consider Before Opening a Fixed Deposit

Despite their simplicity, fixed deposits are not entirely free of limitations. Liquidity is the most important consideration. Early withdrawal is often allowed but usually comes with penalties or reduced interest.

Inflation is another factor. While fixed deposits protect nominal capital, their real return may be eroded if inflation exceeds the interest rate. This does not make them ineffective, but it does define their role as a conservative instrument rather than a growth-oriented one. Terms, interest rates, and early withdrawal conditions may vary depending on the bank and local regulations.

Taxation may also apply to interest income, depending on local regulations. This should be factored into net return calculations.

Conclusion

Fixed deposits serve a clear purpose in personal finance. They are not designed to replace investments but to complement them. By offering predictable returns, capital protection, and structural discipline, they help individuals make better use of idle money without taking on unnecessary risk.

When used appropriately, fixed deposits create financial stability and improve planning confidence. Their value lies not in maximizing returns, but in providing certainty where certainty is needed most.