23.1.2026

Plus and minuses of term deposits

4 min read

This page outlines the main advantages and limitations of term deposits to help readers understand where they fit within a conservative financial approach. The content is provided for informational purposes only.

Term deposits are widely used by individuals who prioritize predictability and capital preservation. They are often chosen as a conservative financial tool that offers fixed returns over a defined period. However, like any financial product, term deposits come with both strengths and limitations.

Understanding the pluses and minuses of term deposits helps place them correctly within a broader financial strategy, rather than viewing them as a universal solution.

Advantages of Fixed Deposits

The advantages of fixed deposits are primarily related to stability and certainty. These products are designed to reduce uncertainty and provide clear outcomes from the moment the deposit is opened.

Key advantages include:

- predictable interest income over a fixed term,

- protection from market volatility,

- simplicity and ease of management.

For example, an individual placing funds into a one-year fixed deposit knows in advance the exact interest income and maturity date, which makes this option suitable for short-term financial planning.

These characteristics make term deposits appealing to conservative savers and short-term planners.

Advantages of a Fixed Deposit Account

Looking specifically at the advantages of fixed deposit account structures, separation of funds is an important benefit. A fixed deposit account isolates saved capital from everyday spending, reducing the risk of impulsive use.

Another advantage is clarity. The account clearly defines the deposit amount, interest rate, and maturity date, which supports financial planning and reduces uncertainty.

In practice, this structure is often used by individuals who want to separate savings for a specific goal, such as a future purchase or planned expense, without the temptation to access the funds prematurely.

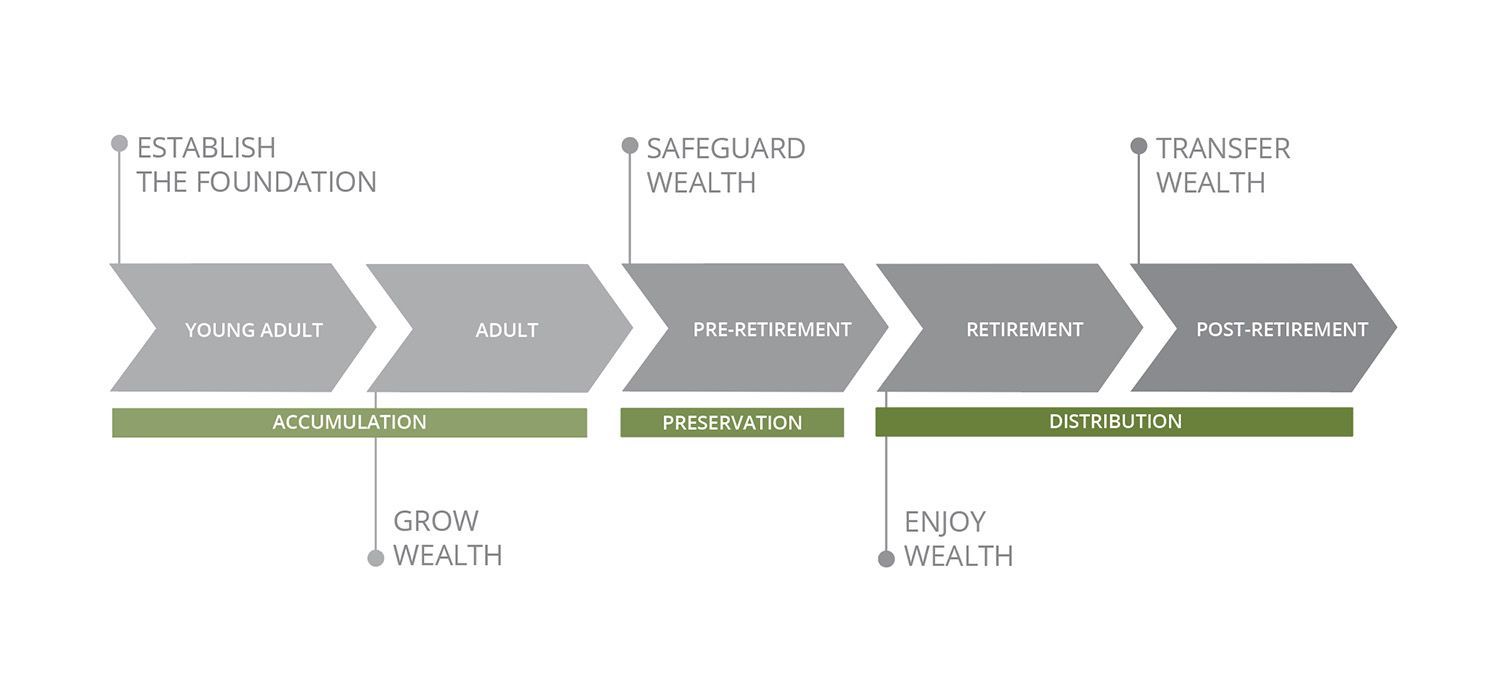

Fixed Deposit Strategy: How It Fits into Financial Planning

A fixed deposit strategy focuses on using term deposits intentionally rather than reactively. This strategy often involves aligning deposit tenures with specific financial goals, such as planned expenses or capital preservation periods.

To apply this strategy effectively, individuals typically follow these steps:

- Identify surplus funds that are not needed immediately.

- Define a time horizon for those funds.

- Select an appropriate deposit term.

- Combine term deposits with more liquid instruments.

- Review allocation periodically as circumstances change.

This approach helps balance stability with flexibility.

Fixed Deposit vs Saving Account

The comparison of fixed deposit vs saving account highlights a fundamental trade-off. Fixed deposits offer higher predictability and often higher interest, but at the cost of liquidity. Savings accounts prioritize access and flexibility, even if returns are lower.

| Feature | Fixed Deposit | Saving Account |

| Access to funds | Restricted until maturity | High liquidity |

| Interest rate | Usually higher and fixed | Lower, often variable |

| Predictability | High | Medium |

| Suitable for | Planned goals | Daily use & emergencies |

| Risk level | Low | Very low |

Choosing between the two depends on intent. Funds needed for emergencies or daily use are better kept in savings accounts, while surplus funds with a defined timeline may be better suited for term deposits.

Key Limitations of Term Deposits

Despite their benefits, term deposits are not without drawbacks. Limited access to funds is the most significant limitation. Early withdrawal may result in penalties or reduced interest, which can undermine expected returns.

Another limitation is opportunity cost. Funds locked into a term deposit cannot be reallocated easily if better opportunities arise or interest rates increase. This limitation becomes especially relevant in periods of rising interest rates, when locking funds early may reduce overall returns.

These limitations highlight why term deposits should be evaluated carefully within the context of broader financial goals.

Conclusion

Term deposits offer clear advantages in terms of stability, predictability, and simplicity. At the same time, their limitations around liquidity and flexibility mean they are not suitable for every financial need.

When used deliberately and as part of a broader plan, term deposits can play a valuable supporting role. Understanding both their strengths and weaknesses allows individuals to make more informed and balanced financial decisions.